Here you will find the latest News updates, HMRC updates, Company Announcements and other information to help you keep up with any changes that you may need to know regarding you Accountancy or Tax Planning. Anything you need more information on please feel free to contact us direct.

Companies House Price Increase

04, April 2024 by Amy Richardson

Companies House have made some recent important changes. Please see below price increases that will take effect from 1st May 2024.

Our processing and administration fees remain unchanged however the companies house increases will be applied to our fees. Please see price increases below:

Company incorporation and registration fees

|

Transaction |

Channel |

New fee |

|

Incorporation |

Digital |

£50 |

|

Incorporation (same day) |

Software |

£78 |

|

Incorporation |

Software |

£50 |

|

Incorporation |

Paper |

£71 |

|

Registration under... |

Read More

Important Changes With Companies House

28, March 2024 by Amy Richardson

Recent important changes with Companies House. The Economic Crime Transparency Act will introduce a number of changes, which is summarised below:

Improving the quality of data on Companies House Registers

The act will introduce new statutory objectives for the Registrar of Companies which they must promote when performing their functions. The act will also provide the registrar with a suite of new and enhanced powers, to enable them to meet their objectives.

The registrar’s objectives are:

- To ensure that anyone who is required to deliver a document to the registrar does so...

Read More

Tax Saving Tips

08, February 2024 by Amy Richardson

Tax Saving Tips

Around 6.8 million taxpayers face being placed into the higher tax bracket next year.

However, with a bit of extra planning and following our useful tips below even those earning

£110,000 will not have to pay high rate-tax.

How to reduce your income tax bill:

• Take advantage of salary sacrifice schemes.

Check if your employer offers a salary sacrifice arrangement for paying into a pension. You

can agree to a reduction in salary or waive a bonus in favour of a pension contribution. By

doing this it is possible for those earning just above the tax threshold to drop a tax...

Read More

Autumn 2023 Newsletter

23, November 2023 by Amy Richardson

AUTUMN BUDGET UPDATE

Taxation and wages

- Main rate of National Insurance cut from 12% to 10% from 6 January, affecting 27 million people

- Class 2 National Insurance - paid by self-employed people earning more than £12,570 - abolished from April

- Class 4 National Insurance for self employed - paid on profits between £12,570 and £50,270 - cut from 9% to 8% from April

- Legal minimum wage - known officially as the National Living Wage - to increase from £10.42 to £11.44 an hour from April

- New rate to apply to 21 and 22-year-old workers for the first time, rather than just those 23 and...

Read More

A simple guide to the Spring Budget 2023

17, March 2023 by Amy Richardson

A simple guide to the Spring Budget 2023

The headline message from the Chancellor

The Chancellor highlighted that “In the autumn we took difficult decisions to deliver stability and sound money… Today, we deliver the next part of our plan. A budget for growth… long-term, sustainable, healthy growth that pays for our NHS and schools, finds jobs for young people, and provides a safety net for older people all whilst making our country one of the most prosperous in the world.”

He concluded his speech stating that “We tackle the two biggest barriers that stop businesses growing: investment...

Read More

State pension boost

02, March 2023 by Amy Richardson

State Pension Boost

The State pension boost is only available until April 5th, so if you are between 45 and 70 you should be checking your National Insurance contributions.

A new state pension was introduced in 2016, and to qualify you need to have been paying national insurance for approximately 35 years.

For those people that do have a shortfall, you could be permitted to buy more years if needed, however time is now running out to make the largest amount possible.

Until the 5th April 2023 you are permitted to buy back missed years back to 2006, however, after this date you will...

Read More

National Minimum Wage Increase

21, February 2023 by Amy Richardson

National Minumum Wage Increase 22-23

On 1st April 2023, the government will increase the National Living Wage rate for workers aged 23 and over.

The Rates are going to be increasing as below:

| National Living Wage | 2022 rate | 2023 rate | % Nominal increase | Cash increase |

|---|---|---|---|---|

| 23 Year old and over | £9.50 | £10.42 | 9.7% | 92p |

| 21 to 22 Year old | £9.18 | £10.18 | 10.9% | £1 |

| 18 to 20 Year old | £6.83 | £7.49 | 9.7% | 66p |

| Under 18 Years | £4.81 | £5.28 | 9.8% | 47p |

| Apprentice | £4.81 | £5.28 | 9.8% | 47p |

It is a legal requirement that minimum wage rates are followed,...

Read More

130% Super-Deduction Ending

20, February 2023 by Amy Richardson

130% Super-Deduction Is Ending

HMRC's Super-tax dedution is coming to an end on 31st March 2023.

Until March 31st companies investing in qualifying new plant and machinery assets will be able to claim:

- a 130% super-deduction capital allowance on qualifying plant and machinery investments

- a 50% first-year allowance for qualifying special rate assets

The super-deduction allows companies to cut their tax bill by up to 25p for every £1 they invest, ensuring the UK capital allowances regime is amongst the world’s most competitive.

The government had offered unprecedented support...

Read More

HM Revenue and Customs Update

20, December 2022 by Amy Richardson

The UK Parliament has released an update on HMRC Making Tax Digital

Across the globe, digitalisation of tax is increasingly the norm. Modernisation of UK businesses and the tax system remains of crucial importance to the UK.

Making Tax Digital (MTD) for VAT is already demonstrating the benefits to businesses that digital ways of working can bring.

MTD for Income Tax Self-Assessment (ITSA) will follow, with businesses, self-employed individuals, and landlords keeping digital records and using MTD-compatible software to submit updates to HM Revenue and Customs.

The government...

Read More

Changes to VAT penalties and VAT interest charges

16, December 2022 by Amy Richardson

Changes to VAT penalties and VAT interest charges

For VAT periods starting on or after 1 January 2023, the default surcharge will be replaced by new penalties if you submit VAT returns late or pay VAT late. There will also be changes to how VAT Interest is calculated.

The changes will affect everyone submitting VAT Returns for accounting periods starting on or after 1 January 2023.

Any nil or repayment VAT returns received late will also be subject to late submission penalty points and financial penalties.

If you submit your VAT return late

Late submission penalties will work on a...

Read More

Christmas Closedown 2022

16, December 2022 by Amy Richardson

Christmas Close Down.

Our offices are closed from Friday 23rd December at 5pm until Tuesday 3rd January, for all services.

There will be skeleton staff in the office processing pre arranged payroll on the morning of Thursday 29th December .

We would like to wish you all a very safe and Merry Christmas, and all the best for the New Year!

Read More

22/23 Tax Updates

19, April 2022 by Amy Richardson

New Directors Salary

Following our previous blog about the updates to National Insurance the guidance on Director salaries are as follows:

The optimum director salary is £11,908.00 per annum, although if you are only a single directors payroll and do not have eligibility for employment allowance, then it maybe more suitable to process your wage on £9100.00 per annum, £758.00 per month. This is up to the secondary earnings limit for National Insurance.

Therefore, there is no tax or national insurance contributions due, so you will not have to worry about paying a monthly liability to...

Read More

Changes to the 2022/2023 Tax Year

22, March 2022 by Amy Richardson

Changes to the 2022/2023 Tax Year

Unless the Chancellor makes an announcement between now and the start of the new Tax Year, which is unlikely, the new changes you need to know are:

2022/2023 National Insurance changes

For earnings below £50,270

National Insurance Contributions for workers and employers increase by 1.25% from 6 April 2022, to 13.25%.

National Insurance Contributions for the self-employed will increase to 10.25%.

For Earnings above 50,270

National Insurance Contributions for workers, employers and the self-employed will be 3.25%

2022/2023...

Read More

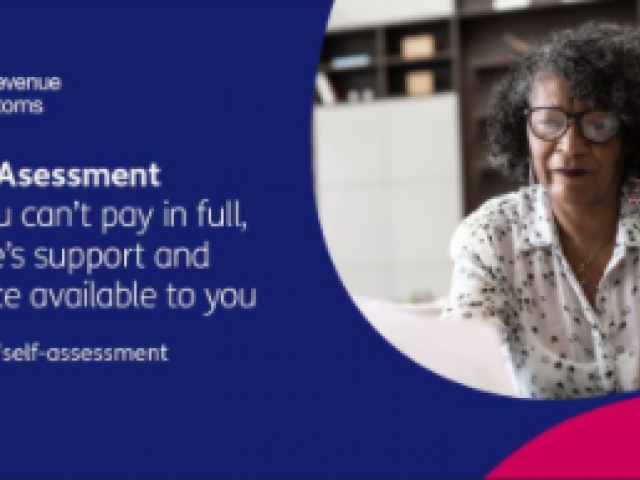

If you cannot pay your tax bill on time

11, March 2022 by Amy Richardson

💥Struggling to pay your Tax Bill ? 💥

HMRC are offering time to pay for Self Assessment and will not apply penalties if you arrange by 1st April .

Snippet below taken from HMRC:

If you cannot pay a Self Assessment tax bill

You can make your own Time to Pay arrangement using your Government Gateway account, if you:

- have filed your latest tax return

- owe less than £30,000

- are within 60 days of the payment deadline

- plan to pay your debt off within the next 12 months or less

If you cannot make your own Time to Pay arrangement online

Call the Self Assessment helpline if you...

Read More

National Minimum Wage and National Living Wage rates

03, March 2022 by Amy Richardson

The hourly rate for the minimum wage depends on your age and whether you’re an apprentice.

You must be at least:

- school leaving age to get the National Minimum Wage

- aged 23 to get the National Living Wage - the minimum wage will still apply for workers aged 22 and under

Current rates

These rates are for the National Living Wage (for those aged 23 and over) and the National Minimum Wage (for those of at least school leaving age). The rates change on 1 April every year.

Apprentices

Apprentices are entitled to the apprentice rate if they’re either:

- aged under 19

- aged 19 or...

Read More

The off-payroll working rules (IR35)

31, March 2021 by Amy Richardson

The off-payroll working rules (IR35)

From 6th April 2021, the off-payroll working rules can apply if a worker (sometimes known as a contractor) provides their services through their own limited company or another type of intermediary to the client. This rule will apply to all public sector authorities and medium and large-sized private sector clients will be responsible for deciding if the rules apply.

If a worker provides services to a small client in the private sector, the worker’s intermediary will remain responsible for deciding the worker’s employment status and if the rules...

Read More

Changes to 21/22 Wages

22, February 2021 by Amy Richardson

National Minimum Wage:

As you may be aware, as of 1st April 2021 the National Minimum Wage is due to increase, new rates are as follows:

|

Age |

23 and Over |

21 - 22 |

18 - 20 |

16 – 17 |

Apprentice |

|

Hourly Rate |

£8.91 |

£8.36 |

£6.56 |

£4.62 |

£4.30 |

Please ensure that all staff members are on pay rates that comply with National Minimum wage and adjust accordingly after the staging date. If your staff member should be under National Minimum wage after this date, we will have to adjust their rate in order to comply before...

Read More

Construction Industry Domestic Reverse Charge- Important Information

19, January 2021 by Amy Richardson

Construction Industry Domestic Reverse Charge- Important Information

As you may be aware there is a major change to the VAT scheme for the Construction Industry which HMRC are imposing. From 1st March 2021 (deferred from 1st October) this Domestic Reverse Charge will come into effect. Businesses that provide construction services in a business-to-business context (only CIS businesses), where the recipient is not the final consumer, must not account to HMRC for VAT on their supply.

This represents a potentially significant financial and administrative burden, as businesses must adapt...

Read More

The New Self-Employment Income Support Scheme Grants have been released by HMRC.

17, January 2021 by Amy Richardson

The New Self-Employment Income Support Scheme Grants have been released by HMRC.

However this time the qualifications to apply for this grant have been revised.

HMRC States that your business must have been impacted by Coronavirus on or after 1st November.

You can make the claim even if you did not need to apply for any previous grants.

In order to claim you must have:

- Have traded in Tax Years 18/19 and submitted a return before 23rd April 2020 and 19/20

And either:

- Be currently trading but are impacted by reduced demand due to coronavirus

- Have been trading but are...

Read More